Marie Nelson is a monetary author, she writes article on debt, mortgage, actual property, foreclosures and supply apt recommendation to the customers. She is related to a monetary group for final 4 years and serving to the customers to deal with their issues.

Schooling is changing into very costly as of late. There are households the place the mother and father will not be in a position to present correct training to their youngsters attributable to enhance within the faculty tuition charges. As such, faculty appears to be a worrying time for a lot of college students. Shopping for books and paying the schooling charges even with monetary hardships is nearly subsequent to unattainable for a lot of college students. Some college students even must forgo faculty and go straight into being employed, after which are compelled into getting their bachelors of accounting for working adults or one other diploma particularly designed for adults later in life to save cash. Thus, taking out a pupil mortgage to rearrange for these bills is helpful because it lets you keep it up along with your larger research and make a shiny profession.

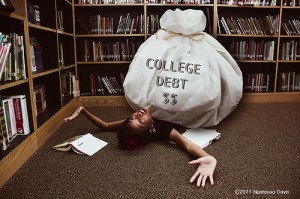

Paying off faculty debt – Why is it so vital?

You might have taken out a pupil mortgage since you didn’t have adequate cash to finish your commencement diploma. It is vital in your half to attempt to repay the school debt earlier than you go out. It’s because when you full your training, you’ll positively search for job. With money owed even after commencement, you will be unable to get an appropriate job. Additionally, your credit score rating will get harm once you’ve money owed to repay. Many recruiters try your credit score rating earlier than providing you with the job. Be sure you have credit score rating earlier than you apply for a job. This can assist them perceive the way you deal with financial issues since faculty and whether or not or not you’re eligible to get the job.

School debt – What’s its have an effect on on a pupil’s profession and life?