Taxes are an inevitable a part of life, and regardless of being a supply of frustration and stress for many individuals, they do play a key half in sustaining the stability and circulation of society as we all know it. Nonetheless, despite the fact that many individuals settle for taxes as vital, they nonetheless need to discover methods to cut back the quantity of tax they should pay.

Regardless that tax payments can typically appear out of your management, there are literally a number of little ideas and methods you need to use to decrease your tax invoice. Many individuals are unaware of the following tips and due to this fact pay extra annually than they actually need to, however this information will present you some easy technique changes you may make to begin paying much less tax.

It’s value noting, additionally, that the monetary planners could be of nice assist relating to chopping prices and paying much less tax. Monetary planners perceive the methods and methods beneath higher than anybody and will work with you that will help you decrease your tax liabilities and maximize returns. However now, let’s check out among the ideas you’ll be able to think about.

Spend money on Your 401(okay)

Probably the greatest tricks to cut back the quantity of earnings tax you must pay is so as to add some extra cash to your 401(okay). The IRS received’t tax you on something you divert to your 401(okay) out of your month-to-month wage, as much as a most restrict, which varies based mostly in your age. It’s a win-win scenario; you get more cash saved up to your retirement and also you get decrease tax payments too.

ALSO READ What Are the Totally different Varieties of Private Loans Obtainable?

Construct an IRA

In addition to a 401(okay), you can additionally think about an IRA as a technique to put together to your retirement and lower your expenses on taxes within the course of. Contributions to a standard IRA could be deducted out of your earnings tax, as much as a specific amount. The worth of your deductions will rely upon numerous elements, like your wage and your partner’s retirement plan scenario. It’s value noting that Roth IRA contributions usually are not deducible.

Contribute to a Well being Financial savings Account

In case you have an eligible medical plan, you might need to think about opening up or contributing to an present well being financial savings account. Any contributions to those accounts present rapid tax deductions and provide you with some funds to attract from sooner or later for medical emergencies. Plus, any cash left over on the finish of the yr merely rolls over into the following.

Use Your Aspect Hustle

At the moment, many individuals have aspect hustles to make some further earnings on the aspect, along with their common jobs. You should utilize your aspect hustle to assert some deductions too. For instance, individuals who use their automobiles for ride-sharing can deduct the price of mileage and gas, whereas those that run small companies from dwelling can declare on their web charges and workplace provides.

For Self-Employed People

People who find themselves self-employed are additionally entitled to many further deductions on their taxes, based mostly on prices they should cowl all year long to assist their enterprise. Residence workplace prices, journey prices, gear prices, and extra can all be deducted, and you may converse to a monetary advisor to study extra. What’s extra, self-employed people can deduct 50% from the Federal Insurance coverage Contributions Act tax.

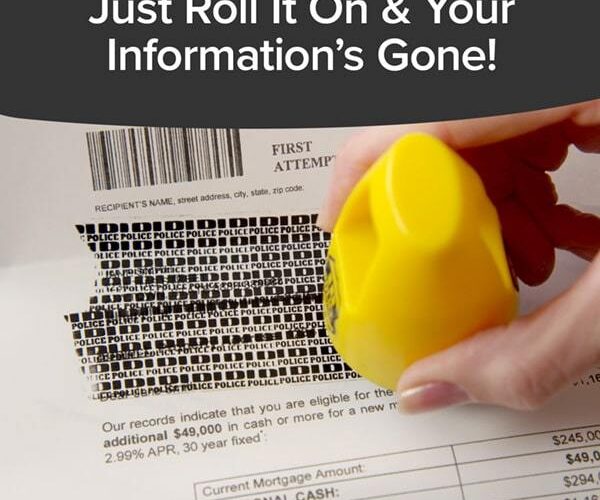

ALSO READ Why Fee Safety is Essential in a Paperless World

Pursue Schooling

You may as well declare tax credit if you happen to’re pursuing greater schooling. The American Alternative tax credit score, for instance, could be claimed throughout the first 4 years of faculty. You may as well deduct some prices if you happen to’re saving up cash in a 529 plan to your child’s school fund too. The principles on this could range from state to state, however there are all the time methods to avoid wasting relating to college and research.

Be taught About Earned Earnings Tax Credit score

The Earned Earnings Tax Credit score (EITC) is a kind of tax credit score that’s depending on the amount of cash you earn annually. The principles are a bit complicated, however in accordance with the newest information, you’ll be able to probably qualify for this credit score if you happen to earn lower than $57,000. The credit score could be value as much as $7,000, so it’s very a lot one thing that you need to study if you happen to assume you meet the factors.

Closing Phrase

These are simply among the some ways in which you’ll declare deductions and credit to cut back the quantity of tax you pay annually, serving to you save extra of the cash you earn. Converse with a monetary advisor or planner to study much more methods to avoid wasting.