Each as soon as a decade, technological innovation and buyer demand merge in a means that drastically adjustments the consumer-facing monetary service sector.

For example, when The Motley Idiot, eTrade, and Intuit got here into the market many years in the past, customers took it upon themselves to personally handle their funds and make investments their financial savings in locations that will get them most returns.

In 2022, the monetary service business is once more observing disruption. Quite a few technological and financial components have developed an ideal state of affairs the place persons are deciding how they wish to handle their funds, finance a automobile or house, pay for companies and items, and even borrow cash.

To reply these adjustments and form the way forward for finance, quite a lot of tech-driven consumer-facing monetary companies firms have entered the marke. The entrants have develop into the rationale why lending has develop into one of the vital worthwhile finance app concepts.

On this article, we will likely be diving into the numerous adjustments that now stare on the lending-centric shopper monetary companies panorama and the way digital applied sciences are fueling this shift in fintech. However earlier than that, let’s perceive what’s shopper lending in banking?

Shopper lending is a type of financing that gives credit score to a shopper for private or family use. In some cases, the lender could also be a financial institution or monetary establishment. At different instances, the lender could also be a enterprise that provides in-house credit score in alternate for the enterprise of the patron.

Transferring ahead, we are going to talk about the components contributing to the evolving panorama of shopper financing.

What’s Contributing to the Evolving Panorama of Digital Shopper Lending?

The altering area of digital lending transformation is bringing a exceptional shift in credit score evaluation and financial institution loans. The rise of technological progress and massive knowledge has led to a collection of alternate options coming into the market questioning the credibility of credit score scores – a primary issue driving the patron lending business.

After we dive into the adjustments which are happening within the monetary sector, we will discover 4 components fueling the digitalization of the patron financing

- Altering shopper behaviors – particularly the COVID-19 pushed habits

- Fast technological adjustments

- Adjustments in compliance and rules

- Improvements occurring within the area of simplification of working fashions.

The mixture of those 4 components has given delivery to a time the place shopper insights are blended with product improvements to make fintech shopper lending much more inclusive. Along with serving solely the excessive credit-worthy customers, the way forward for monetary companies is now powered to contain shopper segments with low credit score historical past (low-income households, college students, freelancers, and so forth.).

The digital lending panorama has grown to an extent that it could now be categorized into two sectors –

The final word purpose of the technology-induced digitalization occurring within the sector – throughout the three subsets – is to digitize all the buyer journey (from KYC to reporting) at velocity and at a degree the place the standard lending system might by no means attain.

How is Digital Lending Altering with Technological Developments?

Know-how is fuelling the lending revolution. Not too way back, getting a mortgage was a prolonged and time-consuming course of. There have been tedious varieties to fill and approval instances from lending companies stretched to weeks. The altering technological panorama has confirmed to be a spine within the banking and monetary companies business. With the rise of fintech companies utilizing cutting-edge applied sciences, debtors can get instantaneous mortgage approvals and cash of their financial institution accounts in a few hours.

Allow us to now have a look at a number of the methods through which digital lending expertise is altering with technological developments:

New credit score mechanisms are constructing on the proposition that conventional methods of candidates’ approval on the idea of FICO credit score rating is an incomplete signal of candidates’ creditworthiness.

By integrating synthetic intelligence, new fashions are being developed. These fashions consider info surrounding 1000’s of knowledge factors like employment historical past, schooling particulars, and spending habits to confirm if an applicant will be capable to clear the money owed on time. On the idea of those insights, a brand new credit score rating mechanism is coming to the floor as the way forward for lending.

2. AI-backed technique and gross sales streamlining

Digital lenders have began asking their partnered fintech app growth firms to make use of machine studying and AI in banking for enhancing mortgage expertise by making underwriting selections. The algorithms might help validate if the candidates are telling the reality about their earnings degree.

The method is greatest suited to individuals having an inadequate credit score historical past, much less earnings, or anybody who’s charged increased curiosity due to the dearth of monetary knowledge. Machine studying can also be getting used closely for its capability to detect fraud by way of evaluation of buyer habits backed by the point they spend answering functions’ questions, trying on the worth choices, and so forth.

3. Blockchain eliminating the necessity for intermediaries

By the mode of blockchain, digital lending firms can develop a excessive belief, low-cost platform. With the whole mortgage course of current on-line, customers will be capable to hold a report of paperwork and transactions on an nameless digital ledger platform, thus eliminating the necessity for third events and intermediaries.

4. Cloud computing fixing digital lending sector uptime issues

The commonest corners of the lending sector are – safety, storage, and 24*7 maintenance time. Cloud computing solves all these points along with providing a collection of further advantages like:

- Safe connections

- Price-effective and time-efficient administration

- Catastrophe restoration

- Simplified on-line processes

- Automation of processes

Whereas these applied sciences are enjoying a key position in bettering the state of digital lending, what’s vital for the sector to maintain evolving. A means the sector can hold getting environment friendly is by realizing the traits which are ready for them in 2021 as the way forward for shopper credit score.

- Neo-banks enhancing buyer expertise

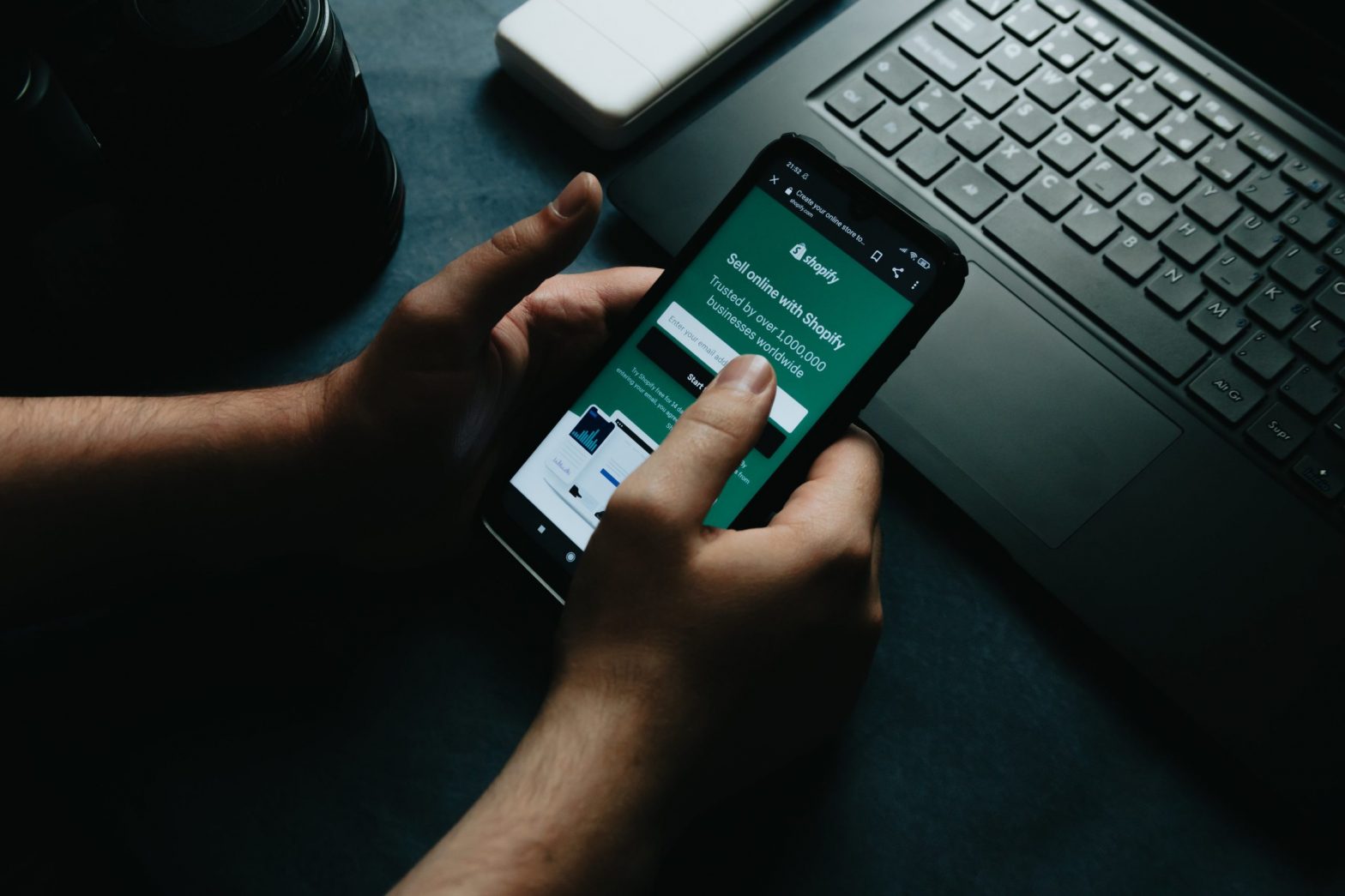

As web penetration is growing and an increasing number of persons are getting snug with dealing with transactions over their telephones, the prospects of app-only ‘neo banks’ are growing.

Neo financial institution is a sort of digital financial institution with none branches. Fairly than being bodily current at a particular location, neo banking is solely on-line. Because the monetary panorama is shifting in direction of enhancing buyer expertise and satisfaction, a spot has developed from what the standard banks provide to what prospects anticipate. And, neo banks are attempting to fill that hole.

Whereas these applied sciences are enjoying a key position in bettering the state of digital lending, what’s vital for the sector is to maintain evolving. A means the sector can hold getting environment friendly is by realizing the patron lending traits which are ready for them in 2022 as the way forward for shopper monetary companies.

<

The lending panorama is repeatedly evolving and it’ll solely get higher. As extra disruptive applied sciences emerge and newer use circumstances are developed, fintech firms will most certainly outperform conventional lending channels.

On this part, we will likely be discussing just a few market traits that may form the way forward for finance and on-line shopper lending in 2022. So, let’s dive in!

Good lending programs will likely be utilizing NLP for recognizing and understanding prospects’ questions and changing them into actionable knowledge. There are a number of functions of NLP that the digital lending firms will likely be experimenting with in 2022 –

- Lenders will be capable to provide recommendation to fundamental queries by way of a chatbot

- They may use the expertise for analyzing prospects’ suggestions and getting insights that may assist them enhance the client expertise.

- Lenders will be capable to analyze the info to higher the credit score scoring accuracy

2. Regulatory sandboxing will improve safety

Whereas the patron lending business wants fixed innovation in an effort to develop and develop, it additionally wants regulation for making certain safety, security, and ethics. Sandboxing is how each components could be revered within the trendy lending system.

It’s the mode of testing modern companies in a managed setting for the regulators to conduct their assessments earlier than a whole rollout. The Compliance Help Sandbox (CAS) Coverage, introduced in 2019 highlights the method. It says,

“After the [Consumer and Financial Protection Bureau or CFPB] evaluates the services or products for compliance with related regulation, an authorised applicant that complies in good religion with the phrases of the approval can have a ‘secure harbor’ from legal responsibility for specified conduct through the testing interval. Approvals beneath the CAS Coverage will present safety from legal responsibility beneath the Fact in Lending Act, the Digital Fund Switch Act, and the Equal Credit score Alternative Act.”

3. Better omnichannel capabilities

Know-how will likely be seamlessly connecting the lender with debtors by way of a self-service holistic digital expertise. The 12 months will see debtors selecting up on the half software type which they began on their cellphone or, their laptops.

Omnichannel capabilities that make it simple for them to leap from one platform to a different with none shift in expertise are what would assist the digital lenders rule the 12 months whereas turning into one of many key cell app growth monetary companies.

4. Non-banking establishments will proceed coming into the area

Now we have already seen Amazon providing loans to small companies and Apple saying its bank card. All of those improvements are the superior levels of firms’ capabilities and the way they assist their prospects attain their targets.

The 12 months will see the patron finance market getting launched with a better variety of P2P shopper lending organizations. Backed by the skills of new-gen applied sciences like Blockchain and synthetic intelligence, shopper financing firms will likely be giving banking establishments powerful competitors.

For small companies, private contact with a banker goes a great distance towards stopping defaults. An AI device might watch macroeconomic traits and monitor particular person debtors’ funds, alerting a lender when a mortgage could be headed for bother. That essential advance warning can allow lenders to achieve out and work out a proactive plan with the enterprise. On the flip facet, AI applied sciences might additionally nudge small companies to prepay on their loans after they’ve had a terrific month, enhancing the chances of full reimbursement and producing buyer loyalty.

Now that we now have regarded into the numerous methods on-line shopper lending companies are getting ready to rule the sector by way of their partnership with a talented fintech software growth firm, allow us to shut the article by trying into some methods you may develop into the subsequent huge digital lender.

[Also Read: How to build a loan management system?]

There are a selection of manufacturers which have positioned themselves in the way forward for the patron monetary behind their digital inclination.

Shifting from a standard lending mindset to a digital bank-oriented one will not be a simple process. There will likely be resistance to vary, an unacceptance in direction of danger, and different issues. A digital financial institution transformation would require a strategic basis supported throughout all group ranges. As a lender, you’ll have to deal with providing an distinctive digital expertise to your customers. The very last thing you’d need is providing a foul expertise to prospects and lack of regulations-compliance assurance.

Listed here are some issues that we suggest on the idea of our intensive talent set as a monetary software program growth firm –

- Present clear info on the approval pointers

- Develop new coaching materials, gen-z inclined communication about new insurance policies

- Present alternate channels to your customers. Don’t power them to go to branches.

The key sauce of your lending enterprise success will likely be transparency and communication. The extra open your small business is, the extra would be the probabilities of your customers to decide on various shopper financing fashions.

The digital lending panorama will proceed to be pushed and formed by innovation and market expectations. Profitable fashions share sure similarities that may doubtless stay outstanding within the instances to return. They supply buyer knowledge digitally, depend on tons of of knowledge factors to accumulate prospects, provide instantaneous and distant approval, design data-driven mechanisms to provoke reimbursement, and have interaction prospects on-line.

Superior digital lenders present prospects with a quicker, handy, and extra clear service. To match up, conventional banks and lending establishments must give prospects related advantages.

In case you want any help, we might help you strategize your digital lending course of. Contact our workforce of strategists. The consultants will information you thru the method and enable you develop into a number one digital lender on this aggressive monetary panorama.

THE AUTHOR Sudeep Srivastava Co-Founder and Director Prev PostNext Submit