Know-how continues to evolve and with every evolution, a number of sectors begin to profit from the method.

One such know-how profit was seen in 2004. The launch of Selenium, an automation instrument that modified the way in which enterprise sectors functioned of their funnel levels. Other than the a number of widespread sectors, the impression of know-how mirrored advantages particularly for the monetary sector.

The finance business was at all times overshadowed by their uncertain safety monetary providers measures. From managing knowledge techniques to sustaining it, relating to safety, the finance business has points. Cloud and SaaS can go a good distance in the direction of supporting inclusive banks within the developed world.

Nonetheless, these points may be eradicated if the finance business implements SaaS progress for his or her safety measures. As per financesonline, the SaaS house will develop to $623bn in market capitalization by the yr 2023.

That will help you perceive the impression and benefit of this SaaS progress price course of and bootstrap your SaaS enterprise, let this weblog be your information.

Why Ought to Monetary Providers Flip Their Consideration In direction of Saas?

Monetary establishments should be capable to join successfully with their shoppers, ship nice service, improve effectivity, and cling to tight legal guidelines and laws all whereas saving cash. This may be executed effectively by SaaS banking. There are a number of Welcome-kits, varieties, statements, and dunning texts for the monetary providers authority sector that show to be important for organizations to speak with their purchasers.

Consulting, coaching, training, help and upkeep providers are all a part of the safety as a service instruments. These providers help purchasers in comprehending their options and procedures.

Throughout the projected interval, the answer phase is predicted to have an even bigger market share. A substantial variety of Small and Medium-sized Enterprises (SMEs) are utilizing safety as a service answer to guard their enterprises from cyber threats throughout their cloud-based functions and platforms.

This use of revolutionary safety providers has introduced SaaS finance or monetary service establishments as much as par with their world competitors and has modified the standard banking practices.

The banks’ Digital Fund Switch (EFT) service has modified the cash switch panorama, and the Digital Clearing Service (ECS) has aided massive firms in paying their salaries, dividends, curiosity, and refunds electronically on time. The financial phase right now operates in a extra aggressive setting than up to now, facilitating a comparatively massive quantity of worldwide budgetary streams and channels.

The collection of the perfect SaaS finance instrument is important to the challenge’s success. Automated instruments are straightforward for learners to get began with as easy setup digital instruments run by way of a number of browsers. Take a look at instances are constructed up of repeatable routines, permitting for extra productiveness with much less upkeep. And when you make adjustments to a ceaselessly used process, the adjustments are immediately mirrored in all acknowledged processes with comparable parts. Digitized processes scale back the issues that workers face when performing important duties every day in a big establishment.

Advantages Of Cloud Internet hosting

There are quite a few advantages of cloud internet hosting in banking and monetary providers, one being eliminating the necessity to contemplate any {hardware} maintenance in an information heart just about connections or onerous drive upkeep.

Your website is protected from any bodily server considerations, similar to safety points and {hardware} breakdowns, with cloud servers and E2E cloud.

Essentially the most important benefit of Cloud Server is by way of safety. A cloud is an immaterial object. Server Internet hosting, alternatively, is sure by the identical safety insurance policies as its customers. Firewalls, antivirus scanners, and DDoS (distributed denial of service) safety are all accessible on numerous cloud servers.

Cloud servers was once troublesome to handle and make the most of, and scaling and optimizing your server required expertise. With right now’s newest know-how and cloud internet hosting, you possibly can simply hold observe of your web site and request on-demand assist 24 hours a day, 7 days every week to change your internet hosting by an easy-to-use dashboard. All your knowledge are saved in a number of places all through the cloud, making it simpler so that you can entry them rapidly and with none problem. Additionally with a view to run a cloud server, technical information isn’t required.

Preventing towards cyber assaults

Even if the monetary business is likely one of the most closely regulated and guarded on the subject of cyber defenses, fraudsters are nonetheless pursuing the precious data held by these companies. Based on Enterprise wire, 73% of fintech SaaS corporations have no less than one important safety misconfiguration.

Therefore such threats should be addressed from a defensive standpoint utilizing a three-tiered method which incorporates folks, procedures, and know-how which is well doable in a Saas monetary mannequin.

A cyber assault on a monetary establishment will trigger much more harm than simply cash alone. Individuals think about monetary establishments as a result of they imagine they’re safer than different choices. With an information breach, traders and prospects will lose religion within the SaaS improvement firm and the underside line will endure in consequence. The method must be SaaS banking to unravel such points.

Safety plan

SaaS business progress helps to design a complete cybersecurity plan to your monetary group as a strategic associate. They might implement a bunch of skilled safety professionals with intensive expertise coping with monetary establishments’ most urgent cyber threats.

As per some reviews, 28% of IT leaders are already utilizing some type of SaaS financing administration instrument to get visibility into shadow IT that’s mandatory to guard their knowledge and techniques.’’

SaaS product concepts present a spread of economic providers authority to help your monetary safety community measures, check your defenses, and discover any gaps within the current data safety SaaS method. They’ll additionally present a complete set of SOC-as-a-Service capabilities and providers to safeguard your community, endpoints, cloud apps, and infrastructure.

Safety within the SaaS enterprise monetary mannequin is a heated subject. Professional help is on the market by SaaS financing primarily based applied sciences that can assist you deal with compliance points and cyber risks. To fulfill the monetary sector’s cybersecurity wants, they mix monetary experience with intensive cybersecurity expertise.

To allow correct decision-making and future planning, each group ought to generate reviews with significant knowledge collected from all sources possible. As a substitute of a separate design for quite a few platforms, the reviews developed utilizing cloud-based safety service platforms are unified right into a single dashboard. The method of evaluating all your knowledge and enter is finished in a extra strategic method utilizing report-generating capabilities.

Advisory advantages

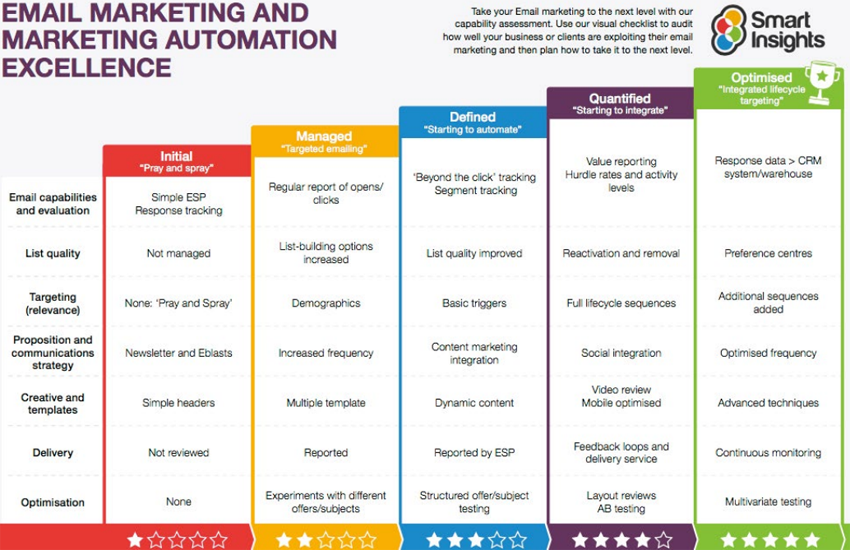

Many restrictions necessitate the implementation of a complete cybersecurity program by monetary organizations. SaaS safety instruments can help you in growing or refining your software to fulfill this criterion. They assess your current program maturity, establish its strengths, and supply a whole evaluation, in addition to an in depth motion plan to deal with any shortcomings and deal with your most urgent wants.

SaaS safety instruments customise their evaluations to offer an goal evaluation of your safety monetary providers program compared to the GLBA and different laws’ standards. They’ll additionally advise your monetary providers software program corporations on the perfect methods to unravel compliance or general safety deficiencies.

These instruments embrace a wide range of red-team and tabletop actions for placing your cybersecurity program by its paces just about the real-world circumstances. These workouts can be utilized to check the technical points of your monetary safety providers program on a purposeful stage, or they can be utilized to check your organization’s safety program at a better, company decision-maker stage.

Insider Threats

Lastly, a complete cybersecurity technique should bear in mind the people concerned. In consequence, SaaS-based functions exist to help detecting and stopping insider threats, blocking superior and chronic bots and digital skimming assaults. They defend your web sites and functions from automated assaults whereas enabling business-critical site visitors to cross unhindered. However, these monetary safety providers develop Consumer-Aspect Safety options which are customisable in keeping with your establishment.

Conclusion

Monetary establishments deal with massive quantities of extraordinarily delicate personally identifiable data and should adhere to the strictest monetary safety community requirements. To keep away from expensive breaches and non-compliance, SaaS enterprise monetary fashions defend your buyer knowledge and business-critical apps wherever they reside.

Present safety as a service platform and SaaS software improvement firm in USA helps you in making certain a easy and fast cloud migration whereas being safe and compliant. Whether or not on-premises, within the cloud, or a hybrid setting, SaaS monetary fashions and functions may help you handle threat and higher defend your belongings.

THE AUTHOR Sudeep Srivastava Co-Founder and Director Prev PostNext Publish