Our lives have been closely impacted by digitization in lots of spheres and investing is not any completely different.

When investing in shares first grew to become in style, many people needed to do it, nevertheless it demanded particular coaching, brokers, brokers, and different issues. Nevertheless, all we want at present is a smartphone and an funding app! Sure, the flexibility to handle micro-investments is now sensible for even an adolescent.

The prevalence of micro-investing is at an all-time excessive, and even youngsters can entry the markets. Passive revenue is turning into engaging to millennials, and grandparents at the moment are giving their grandchildren Apple shares as a birthday current. All of that is made doable due to the funding functions. The market craze for these apps is subsequently evident.

The revenue margin of getting an funding cell app is illustrated by a number of figures. Listed below are a couple of:

- Google searches for investments have elevated yearly by 115%.

- In response to Statista, the worldwide e-trading market is anticipated to extend from $8.7 billion in 2021 to $12.16 billion in 2028, indicating a CAGR of 5%.

- Inside the final 12 months, a minimum of 10% of individuals throughout all age teams used a web-based funding software.

- In response to a Bankrate ballot, 63% of smartphone homeowners have a minimum of one monetary app put in, and 17% of those are stand-alone funding apps.

In response to the above information, demand for funding platforms is already at an all-time excessive, and the long run development price will likely be significantly increased.

Moreover, the numbers indicate that your determination to develop a brand new and the very best on-line funding app is supported by each market information and inner instinct.

An intensive reply is a should on the subject of find out how to create an funding app. Due to this fact, learn our complete article on how to reach funding app improvement if you wish to be a part of the league of suppliers of funding choices.

Earlier than you begin creating your funding app, you want to put together your self. Primarily based in your finalization of the kind of software, you can be required to create the options and determine on the workforce measurement, construction, and know-how for use. Listed under are a few of the generally used funding apps:

Training-centered funding apps:

Newbies can purchase the basics of economic literacy with assistance from this class of funding app.

Instance: Invstr

Apps for conducting trades:

This kind of funding app permits inventory buying and selling and may make investments in your behalf.

Examples: Robinhood, Charles Schwab, Stash

Apps for brokers:

These apps cater to clients who already perceive what they need to purchase. Sometimes, you’ll be able to commerce each fiat cash and cryptocurrency right here.

Examples: WealthBase, Ellevest

Banking apps:

These quite a few on-line banking companies and apps let customers handle their accounts and perform transactions, deposits, investments, taking loans, and extra. Such apps usually belong to licensed monetary establishments.

Examples: Chime, Chase Cellular, Ally Financial institution, Financial institution of America

Why must you create an funding app?

An funding app gives you real-time details about publicly traded firms. This cell software empowers you to remain up to date on the inventory market and different monetary sector investments. Having a hawk’s eye on the funding market helps you capitalize on the available data at your fingertips at nominal software charges. Listed below are a couple of causes you must contemplate constructing an funding app.

- The overwhelming reputation of the digital funding business is the primary motive for constructing an funding app. Increasingly more customers are experimenting with inventory buying and selling, portfolio administration, and saving methods.

- The abundance of niches you’ll be able to inhabit is the second argument in favor of constructing an funding app. You may want to develop a platform for brand new customers to study, add retirement plan choices, and even begin promoting reward playing cards for cryptocurrency purchases.

- One other issue to consider is the price that beginner traders are ready to pay for a portfolio with a various vary of investments. Mutual funds, banks, and funding trusts impose exorbitant charges for his or her companies, horrifying away common individuals. Related work is finished on-line however at a far decrease value. Extra alternatives can be found if you’re keen to pay the next price, together with managing margin accounts, working extra hours, and reaching particular person investing targets.

The way to develop a cell funding app?

With rising market demand and expectations of the customers, a sturdy and complex cell funding app has develop into essential of their checklist of functions on their handhelds. To remain related, aggressive, or higher forward within the race of most used and preferred apps, creating a purposeful and user-friendly app necessitates following a structured method. Listed below are the 5 steps you need to observe to place your worries about find out how to develop the very best cell funding app to relaxation.

1. Plan

Give your self ample time to contemplate and plan the app you’re about to create. It is best to now begin asking your self questions on your organization’s targets. Does your organization truly require funding app improvement? What particular advantages and efficiency enhancements are you able to anticipate? Is that this actually the very best plan of action to your firm’s development? Consider your organization’s tolerance for danger in a number of conditions if one thing goes mistaken.

2. Set up enterprise mannequin

A enterprise mannequin have to be developed on the time of economic planning. What’s going to the price of your companies be? What share of the fee do you hope to obtain? Let’s use Acorn as one of many funding platform examples to your reference. To make use of their companies, customers should pay $1 per thirty days. As well as, it allows customers to revenue from the transaction by pockets and suggestions.

3. Abide by the legislation and the rules

Any legal guidelines and rules that apply to your operations within the nations the place you plan to conduct enterprise have to be strictly noticed whereas creating any FinTech software. The privateness of your customers could also be topic to legal guidelines and rules (corresponding to GDPR), in addition to to your organization’s operations.

4. Perceive compliance necessities

Earlier than beginning the core improvement technique of the funding app, it’s vital to grasp the authorized and regulatory necessities of the area.

Each nation has its personal regulatory physique that units the principles for web house and monetary setting. Nevertheless, the fundamental frameworks stay considerably related and are primarily associated to – finish person privateness, mental property, advertising and marketing and promoting, and cash laundering detection.

Talked about under is the checklist of regulatory our bodies and authorized compliance of the corresponding nations:

| USA | The Anti-Cash Laundering Act 2020, Safety Alternate Act 1934 |

| UK | UK Trade Act, The Rule E book of London Inventory Alternate |

| Canada | Commodity Futures Act |

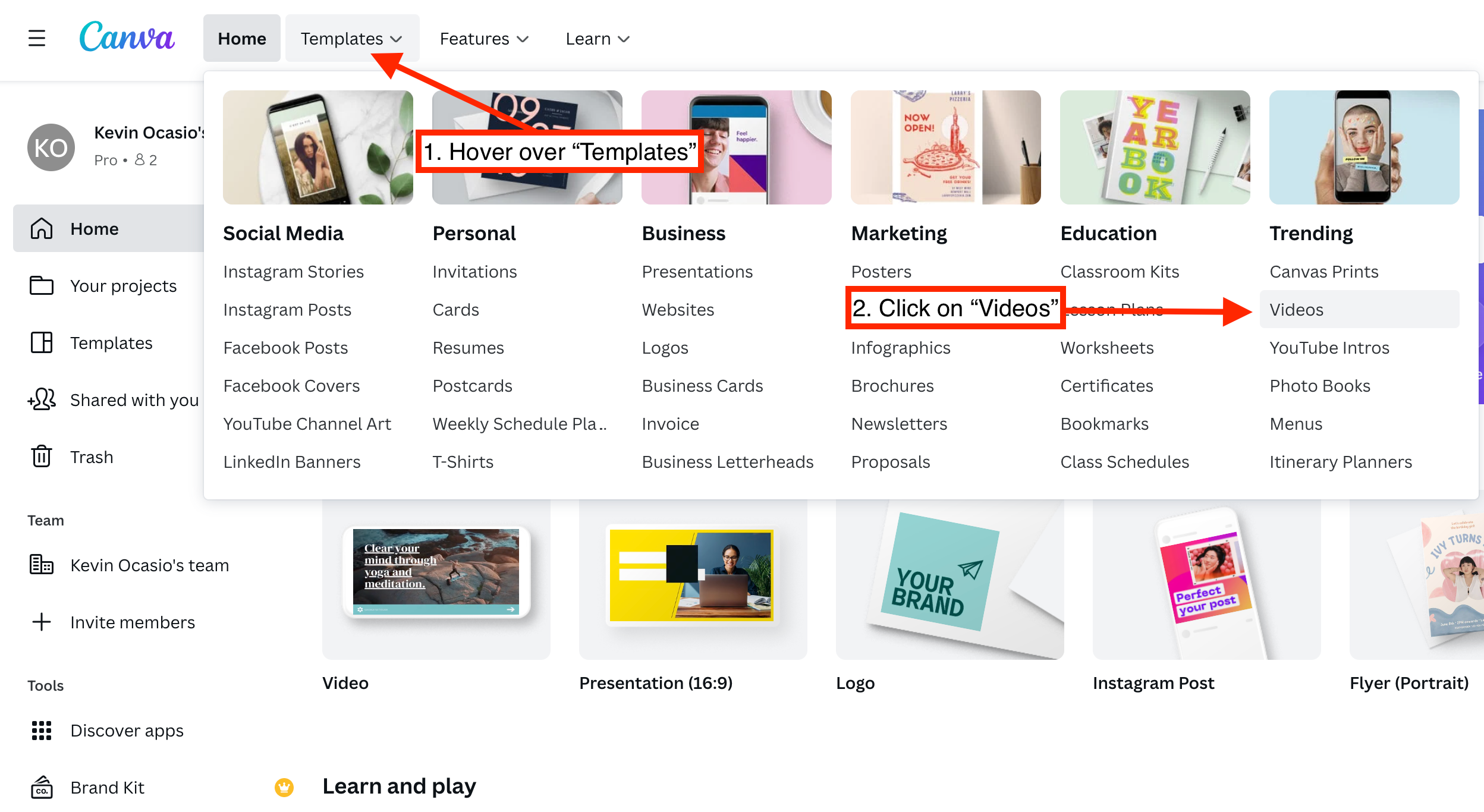

5. Discover the suitable improvement workforce

A number of strategies exist for finding builders. Let’s rapidly go over them and speak about their advantages and disadvantages.

Type an inner workforce

The benefits of this alternative embrace full management over the app improvement course of and simpler communication. Nevertheless, you’ll need to speculate time in recruiting and onboarding, in addition to pay salaries which can be corresponding to these in your business and supply advantages that can maintain your staff on board. You will need to know the workforce construction that may be required to develop an funding app.

| Required Staff Members | Position Description |

|---|---|

| Undertaking Supervisor | The function includes managing the whole challenge that includes coordinating with the event workforce and taking strategic choices. |

| UI/UX Designer | To get the primary look of the product and its functionalities, it’s the duty of the designer to create a wireframe and an actionable prototype of the product. |

| Backend Programmer | Self-described – backend programmer is chargeable for coding options and functionalities on the backend. |

| Cellular Developer | With the interface designed by the UI/UX designer, the cell developer helps in translating the code into the cell software. |

| QA Tester | Making certain that the app is according to the expectations set within the discovery part. Checking for bugs and loopholes by testing the preliminary software to make sure that no breaches are occurring. |

| DevOps | By bringing collectively operations and improvement, DevOps helps in automating numerous features of the coding course of. |

Moreover, to create an funding app, the workforce must be adept with the below-listed tech stacks:

| Facet | Required Tech Stack |

|---|---|

| Cellular Programming Language | React Native or Flutter for a hybrid app, JAVA and Kotlin for Android app, or Goal-C and Swift for iOS app. |

| Backend Improvement | LAMP, NodeJS, Laravel |

| Database Administration | MongoDB, MySQL |

| UI/UX Design | Balsamiq, Precept, Figma |

| Product Administration | Confluent, Jira Software program |

Contain freelancers

You gained’t be capable to create the very best on-line funding app with only one or two staff as a result of it’s a very advanced course of. The workforce requires many specialists, together with designers, QA engineers, challenge managers, and funding app builders.

Whilst you can recruit freelancers, it’s tough to deal with a contract workforce, fulfill deadlines, and keep inside funds on the identical time.

Be a part of forces with a software program improvement firm

With this alternative, you get the very best of each worlds: you solely pay for the work that’s delivered, you’ll be able to develop or scale back your workforce as wanted, and also you obtain a challenge supervisor to ensure your spending is inside motive.

6. Develop the primary app

Provoke the app improvement with the software program improvement firm you employed. To place it merely, it includes creating an MVP for the very best cell funding app. You’ll be able to add extra performance as soon as your cell app has the naked minimal capabilities required to operate. You could, as an illustration, make an funding in next-layer safety and add gamification and enhanced UI/UX parts.

7. Check and enhance

With an MVP current, programmers and QA engineers maintain testing and enhancing the app’s performance, ultimately releasing all options in accordance with their precedence. This stage ends with a completed app that’s made obtainable for buy and obtain.

8. Repairs and assist your app

You’ll have to maintain the present options up-to-date along with creating new ones. Upkeep, which incorporates upgrades to assist the brand new working system editions, library, third-party service updates, and different duties, typically consumes 20% to 50% of the unique app funds yearly.

To forestall safety flaws, it’s essential to improve library and framework variations. Moreover, you’ll want to routinely take a look at your app for velocity and safety flaws.

Naturally, not each funding app improvement absolutely adheres to this course of, significantly with regards to creating the very best cell funding apps. Nevertheless, this technique can work as a strong basis to ensure profitable improvement outcomes. You could transfer on with the event processes methodically and resolve conflicts that come up alongside the best way by specializing in the Agile methodology.

Examples of Profitable Funding Apps

Now that we’ve got discovered concerning the kinds of funding apps and the steps to make a sturdy funding app, allow us to have a look at some examples of profitable funding apps:

- – With negligible administration charges of 0.25-0.40% of the property yearly, this funding app is apt for somebody who likes having a professionally managed portfolio together with a money administration account. The app gives the power of utilizing a number of ETFs which can be calibrated in opposition to your danger tolerance. It caters to completely different shoppers from risk-taking portfolios to safer portfolio administration. It additionally enables you to arrange your targets for funding with no minimal account necessities.

- – There isn’t any minimal stability required to arrange a portfolio with Invstr. For novice traders, this software helps to supply a studying platform by listening to from the specialists about why and which shares are their favourite. The app combines the fantasy inventory recreation for managing digital portfolios that can make it easier to study concerning the shares in a enjoyable approach. They’ve lately began providing commission-free buying and selling in cryptocurrency.

- – This funding app is supposed for traders who like getting computerized investments whereas spending them with out fear or in order for you retirement funding with out trouble. It’s thought-about to be the most effective apps for financial savings.

- – The Robinhood funding app is finest for energetic buying and selling. With zero fee and no required minimal stability, you get a easy interface for buying and selling shares, ETFs, or cryptocurrency. Visually interesting statistics within the type of charts on the inventory web page present an analytical view and facilitate fast buying and selling.

Options Your Funding App Should Have

Let’s now talk about the options of your software, significantly those who your MVP will unquestionably require. These are merely the basic parts that may be present in probably the most well-liked funding functions; you’ll be able to alter this checklist in accordance along with your funding app concepts, funds, and advertising and marketing method.

1. Onboarding and registration

Present customers with the choice to enroll utilizing their telephone quantity, electronic mail deal with, or different particulars. An funding monitoring app will need to have a function to confirm paperwork to make sure that customers are genuine.

It is best to present customers with a walkthrough of your app after they register. Level out the necessary traits and the funding pipelines as you present them round.

2. Private profiles

A person’s portfolio, chosen cost strategies, and private data ought to all be included in a private profile. Private profiles may also have setting choices added to them.

Ensure creating a private account is as simple and intuitive as doable to keep away from pushing aside your customers from the second they begin utilizing your service.

3. Instruments for managing cash

Cash administration instruments have a singular place on this checklist that you want to add in case you intend to launch an investing platform.

Why? Individuals ceaselessly search for the very best method to managing their cash. Due to this fact, you must present your customers with sturdy dashboards that embrace instruments for managing cash, financial savings, and credit score. Use interactive bars, pie charts, infographics, and different visible aids. The data must be insightful and visually interesting all through. Ship every day, month-to-month, and quarterly studies to present your customers a constant impression of their monetary and investing exercise. It’s a good way to spice up person retention to your funding app.

4. Cash withdrawal capabilities

In response to commerce rules, your customers must be given the performance to withdraw their investments into their financial institution accounts. It’s essential to incorporate a checking account into your funding app improvement in an effort to do that.

5. Security and safety

Any funding app will need to have information safety as a regular function. A robust IDPS must be added to deal with DDoS assaults, encryption strategies, anti-spam, two-factor authentication, and phishing safety. The person expertise improves as you add extra safety measures.

6. Push notifications

Don’t neglect to incorporate push notifications, real-time alerts, and customized reminders when creating an funding software. With their help, the system can alert shoppers about intriguing offers, reductions, and promotions, in addition to their present account standing and the rising or falling worth of particular property.

7. Digital pockets

In essence, that is the place the funds for upcoming investments are saved. The important thing necessities are utmost safety and easy accessibility for a person certified to supervise the property saved there. The perfect on-line funding app ought to be capable to connect with the financial institution and bank card networks in an effort to obtain well timed updates and to securely defend person information on the telephone.

8. Monetary data and AI session

An app that permits you to purchase and promote has a decrease worth than one which additionally affords data to its customers about investing. Take into consideration together with monetary literacy training for novices within the type of partaking articles or quick movies, along with an AI-powered guide who assists in making the proper selections by swiftly giving related insights. An AI funding app can even offer you a aggressive benefit out there.

How A lot Does it Value to Develop an Funding App?

A typical funding app improvement prices between $70,000 and $120,000. You should utilize this cash so as to add essential options that allow you to buy and promote property, collect statistics, and use notifications to tell the person of serious occasions. Superior funding app options might be built-in into extra refined options, which value twice as a lot.

The price of improvement can fluctuate relying on numerous elements. The in-house improvement workforce will comparatively value you greater than the price of outsourcing the whole challenge. The price of improvement can be depending on the area the developer is employed from. Outsourcing, usually is the popular alternative as they cost on hourly charges which can be inexpensive. The desk under will offer you a good concept about the price in US $ of improvement based mostly on hourly charges:

| Area/Specialist | Frontend builders | Backend developer | iOS builders | Android builders | UI/UX designers | QA engineers | DevOps engineers |

|---|---|---|---|---|---|---|---|

| North America | 130-150 | 130-150 | 130-250 | 150-170 | 50-150 | 50-150 | 100-150 |

| Australia | 100-110 | 100-110 | 80-150 | 110-120 | 50-150 | 50-150 | 100-150 |

| Europe | 61-80 | 61-80 | 120-175 | 120-175 | 50-100 | 50-100 | 100-150 |

| Asia | 35-55 | 35-55 | 30-75 | 45-75 | 20-50 | 20-50 | 30-50 |

| South America | 45-80 | 45-80 | 80-120 | 80-120 | 50-100 | 50-100 | 50-100 |

Sure different elements come into play whereas considering the event of an app. These embrace:

- The dimensions of the person base/viewers

- Required expertise and experience

- Know-how stack

- Capabilities and funding app options

- Options for security and safety

- App platform and design

The way to Monetize the Funding App?

The tip purpose of making any software normally is to make it worthwhile. Thus, it’s vital to incorporate the monetization methods on the time of planning. There are a lot of methods to become profitable from the applying. Allow us to talk about a few of the generally used strategies

- In-app purchases – When the person turns into aware of the interface and the applying whereas searching for the choices of getting enhanced options and higher management on funding choices, these add-ons are offered on a rechargeable foundation.

- Subscription charge – The funding apps may present you the choice of making your account without spending a dime. Nevertheless, they might cost a subscription charge to facilitate you with buying and selling choices.

- Commercials – Accomplice firms might run advertisements in your app. Customers see these advertisements to maintain the app freed from subscription charges.

Accomplice with Appinventiv to Construct a Sturdy Funding App

Making a cell software appears to be a easy challenge, nevertheless, requires experience on a number of fronts from being revolutionary to know the sector and an skilled and skilled technical workforce. Thus, if you plan to develop a cell app inside a extremely specific class, corresponding to funding, insurance coverage, communication, socializing, and extra, you need to put up diligent efforts.

We at Appinventiv are right here to help in case you’re searching for a talented and dependable monetary software program improvement associate. We’ve a large portfolio of efficiently accomplished initiatives for companies of assorted sizes and working in numerous industries together with FinTech like Mudra, Asian Financial institution, Bajaj Finserv, and extra.

By partnering with us, you might be assured that we’ll give your funding app our full consideration and improve its usefulness with an unlimited array of high-performing instruments and parts.